Haven Capital Partners has completed over $2.5B+ in sale-leaseback transactions. Take a look at some of our recent deals.

Wisconsin

Challenge

The Haven team represented a private equity backed marine company with a network of recreational marine dealerships, service, parts and storage facilities across Florida, Wisconsin, and Illinois. The client was pursuing an add-on acquisition to their existing platform. The business and real estate were being sold together at a ~6.50x EBITDA multiple.

Solution

Haven’s strategy identified an opportunity to bifurcate the real estate from the

operating business to improve the deal economics for the client, therefore allowing

them to offer a more competitive bid and secure the deal with the seller.

Result

Haven procured an institutional real estate partner to acquire the real estate at closing, contributing a meaningful amount of the total purchase price and reducing the post sale-leaseback entry multiple to ~4.75x EBITDA. Additionally, Haven secured a line of credit from the real estate partner to fund future renovation/expansion costs for the recently acquired facilities.

Florida

Challenge

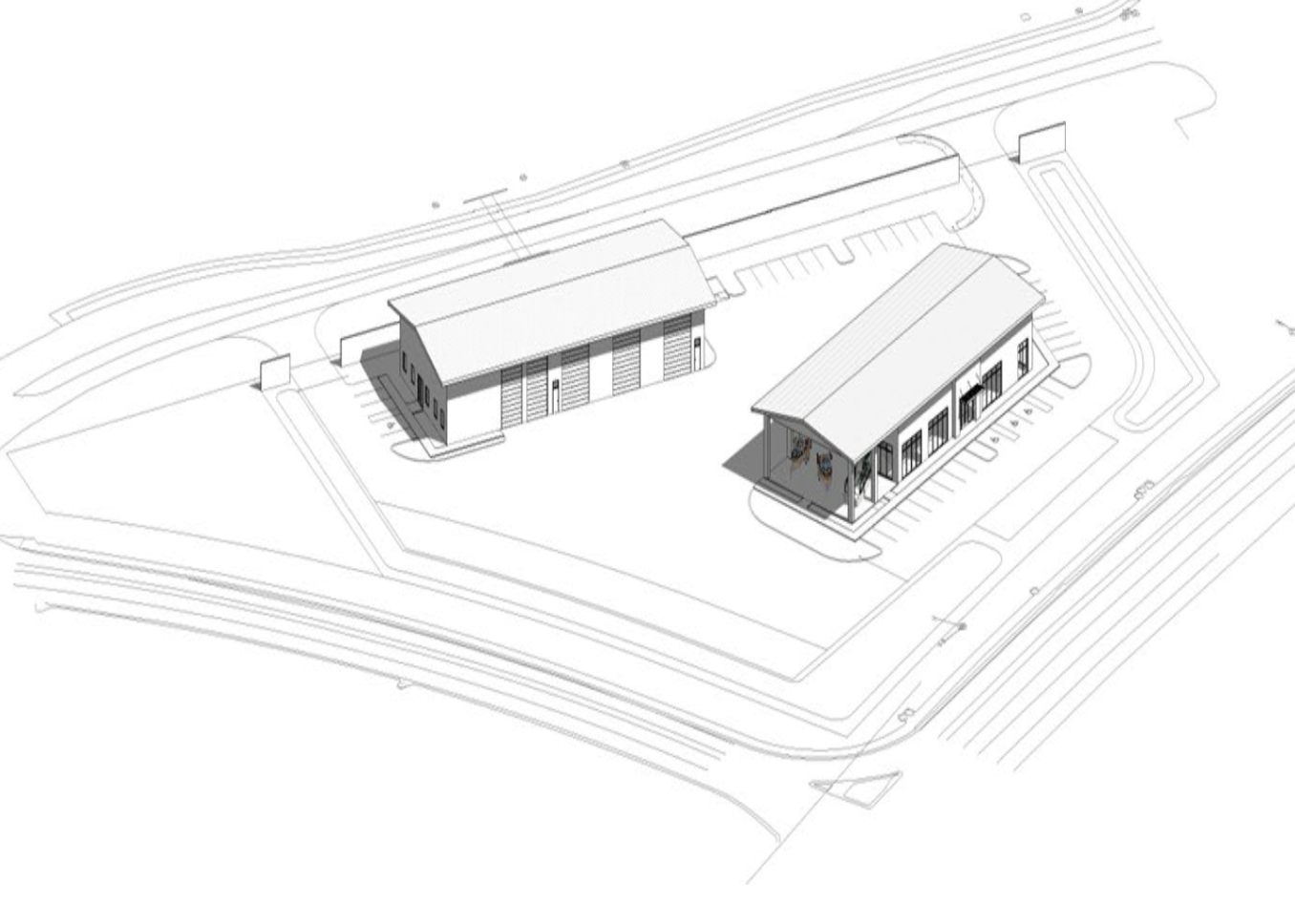

The Haven team was asked to return as representation for a private equity backed marine company to utilize sale-leaseback funds to aid in their expansion. The client planned to relocate their current Florida location and develop a state-of-the-art dealership, showroom and repair facility.

Solution

Haven engaged an institutional real estate partner to purchase the vacant plot of land from the client, while simultaneously leasing it back to them and providing funds to develop the new site.

Result

After a thorough process, Haven was able to carry out all aspects of the

sale-leaseback for the new land purchase and secured substantial funds

for future construction. Upon closing, Haven secured $3.5 million for the

land and $6.4 million for future development.

Partner / Raleigh, NC

As a Partner at Haven and a member of the Executive Committee, Neil brings extensive expertise in commercial real estate, backed by more than 17 years of experience.

Over the past decade, he has specialized in sourcing, structuring, underwriting, and executing sale-leaseback transactions. His leadership has been instrumental in closing over 500 deals for both privately held and public real estate investment firms, contributing to more than $6 billion in gross transaction volume.

Before joining Haven, Neil served as Senior Vice President and Head of Acquisitions at STORE Capital. In that role, he was a voting member of the company’s Investment Committee, managed a team of up to 15 acquisition professionals, and led the disposition strategy.

Neil holds a B.S. in Business Finance from Elon University.

Senior Vice President, Acquisitions / Chicago, IL

As Senior Vice President of Acquisitions and head of Haven’s Chicago office, Matt is responsible for originating new sale-leaseback opportunities for the company, bringing over 9 years of real estate advisory experience to the firm. Prior to joining Haven, Matt served as Vice President in the Net Lease Investment group at Mid-America Real Estate, a Midwest advisory firm specializing in the acquisition and disposition of retail properties throughout the United States. Throughout his career, Matt has facilitated more than $400 million in total real estate transaction volume.

Matt received a B.S. from The University of Iowa and is a licensed real estate broker in the State of Illinois.

partner / Franklin, tn

As a Partner of Haven, John is the head of originations for the company. He is also a member of Haven’s Executive Committee.

Prior to Haven, Mr. Bradley led acquisitions for the Central U.S. at PennyMac Financial Services (NYSE: PFSI), a publicly traded mortgage REIT, where he facilitated the aggregation of $500 million in residential and commercial loans. Before his time at PennyMac, John spent seven years in acquisitions at Essent Mortgage Guaranty Inc. (NYSE: ESNT), a publicly traded mortgage insurer and reinsurer. During his time at Essent, John insured $3 billion in GSE-backed mortgages.

John holds a B.S. from Niagara University. He previously served on the Board of Directors at the Illinois Mortgage Bankers Association from 2017-2020 and as Chairman of the Affordable Housing Committee (2014-2020).